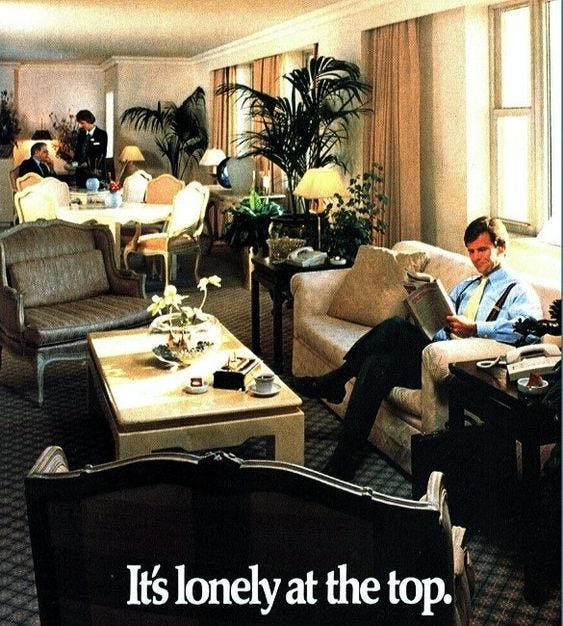

YEAR OF EFFICIENCY

A year of corporate triumph and the erosion of trust - addressing realities of the 21st century corporate environment and how to be a 21st century employee.

MOVEMENT 004

For much of the 20th century, the big winners in business were large manufacturing companies able to grow over a long period of time within a specific industry. A successful employee followed a similar path and they too established their roots and grew over a long period of time, often demonstrating a very specific set of proficiencies. More often than not, they even stayed within the same company.

Time builds trust; it establishes a cadence of predictability and expectation. Trust is good. Trust feels safe and feeling safe gives you the confidence to plan for the future. You settle into your job, buy a house, invest in the market, have kids, etc.

It makes sense from the business side as well. In trying to understand how to create a culture of trust and a more productive workforce, a survey conducted by the Center for Neuroeconomics Studies found the following: Compared with people at low-trust companies, people at high-trust companies report 106% more energy at work, 50% higher productivity, 13% fewer sick days, 76% more engagement, 29% more satisfaction with their lives, and 40% less burnout.

The problem is, many corporate environments today look different…

Arguably the biggest fundamental shift in business between the 20th century and now is the ability for a company to come out of nowhere and scale up 10x in 5 years. The shift that’s not talked about as much is the longevity of these companies.

A recent study by McKinsey found that the average life-span of companies listed on the S&P 500 was 61 years in 1958. Today, it’s less than 18 years. McKinsey believes that in 2027, 75% of the companies currently quoted on the S&P 500 will have disappeared.

Something that is not progressing at an exponential rate is the success of employees - at least in terms of compensation and job security. They are subject to the same shortened timelines their companies are experiencing, however, they are not compensated in nearly the same way.

In the last 10 years the cumulative market cap of the S&P 500 has increased by almost 300% while revenues have grown nearly 200%. Average salaries during the same time have increased by roughly 40%. I understand the average US salary is not always that of an employee at a company within the S&P 500 - but it’s not too far off, and the data over a 10 year period for employees within those companies is tricky to find.

If the accelerated growth of these companies is the result of leveraging less capital-intensive business models, an idillic thought might be that while they require fewer resources to achieve these returns, the employees would be rewarded accordingly. That’s obviously not the case.

I’m not one to bash a company for how much money it makes or how much its board decides to pay its CEO - in fact I tend to lean the other way in most cases. A company is valued by a free market, based on the perceived importance of the service it provides. And a CEO is paid based on the value he/she provides to investors - which according to the data above is going quite well.

So, if companies are exploding (over a shorter horizon) and CEOs are doing just fine - how do we as employees navigate this new landscape?

Chances are the advice from your parents, while well-intended, may not always apply given the difference in landscape they navigated vs the one you now occupy.

Maybe some of these topics will resonate:

Self-analysis: This comes first. Identify what lights you up, what brings you down, what you’re truly good at, and even what you’re good at but you don’t enjoy. Break them down to their core. Be honest with yourself. Think about it over the course of your life - chances are there have been some constants. Understanding the fundamentals in how you operate will come in handy when making decisions throughout your career, big or small. Stick to it - make the selfish decisions that align with your fundamentals.

The target draws the arrow: Map out where you think you want your life to be in the next 3 years, 5 years, 10 years. Where are you? Who are you with? What are you doing? What is the highlight of your day? Now set some goals. Do something small every day that points the needle in that direction - start compounding the progress in your life. In a world where almost no one takes a truly long-term view, the market will reward those who do.

Become a doer: Learn how to get stuff done. Whether a task is small or large, taking the initiative to say, "Let me take care of that," and then doing so efficiently and effectively is the surest way to get noticed. Be the most reliable, capable person who can get things done. Shift your narrative away from explaining the things that need to be done and instead focus on how to get them done. The universe rewards those who ‘do’.

Act accordingly: We’ve been raised to feel that the priorities of a company come before our own, to live in a bit of fear, the inexplicable feeling of ‘I need them more than they need me’, etc. The reality is, that unless you’re reporting to a CEO or founder, your relationship to a company is very much a transaction, and that’s okay. Treat it accordingly - it’s a two-way street. Assess the value you provide to your company and the value they provide to you. If something’s not adding up, don’t be afraid to look for a more attractive exchange of value.

Leverage: The best way to become irreplaceable is to build leverage. For example, you can do it with personal relationships by building a strong personal brand, or by getting good at the intersection of multiple fields. There are many other strategies, but you have to figure out some way to do it. I suggest anchoring it in your identified fundamentals - nobody is as good at being you, as you.

Most people do whatever most people they hang out with do. This mimetic behavior is usually a mistake—if you’re doing the same thing everyone else is doing, you will not be hard to compete with. - Same Altman

MARKET SIGNALS:

01 Employee defiance

In an environment drained of trust and longevity, flexibility in the labor market and more mobility for employees will rise. Also, an increasing number of people will work outside the traditional setup of corporate employment. Entrepreneurship will grow, and the defining characteristics of a ‘career’ may start to transform.

02 Master of none

Because of the above^^ approach towards work, employees will undoubtedly start to develop a broader skillset. Companies willing to adapt and hire accordingly will benefit most. However, this may result in an increase of non-salaried positions.

03 Private longer

When the life-span of prominent public companies is dwindling and the ability to raise large amounts of capital free of public-scrutiny is becoming easier we may see young companies decide to stay private, longer. Employees in these companies will need to navigate their compensation packages accordingly, and investors may start to condense their holdings to de-risk their approach.

04 Full circle

It may be the optimist in me, but I think more and more companies will discover the benefits in slowing their growth, retaining talent, and building trust. This could be a long reversion into something reminiscent of the companies of yesterday.